Renters Insurance in and around Georgetown

Welcome, home & apartment renters of Georgetown!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected catastrophe or mishap. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Allison Dickmann is ready to help you navigate life’s troubles with dependable coverage for your renters insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Allison Dickmann can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Welcome, home & apartment renters of Georgetown!

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

The unpredictable happens. Unfortunately, the stuff in your rented space, such as a TV, a couch and a microwave, aren't immune to abrupt water damage or smoke damage. Your good neighbor, agent Allison Dickmann, is dedicated to helping you choose the right policy and find the right insurance options to insure your precious valuables.

It's always a good idea to make sure you're prepared. Visit State Farm agent Allison Dickmann for help learning more about options for your policy for your rented unit.

Have More Questions About Renters Insurance?

Call Allison at (512) 868-1088 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

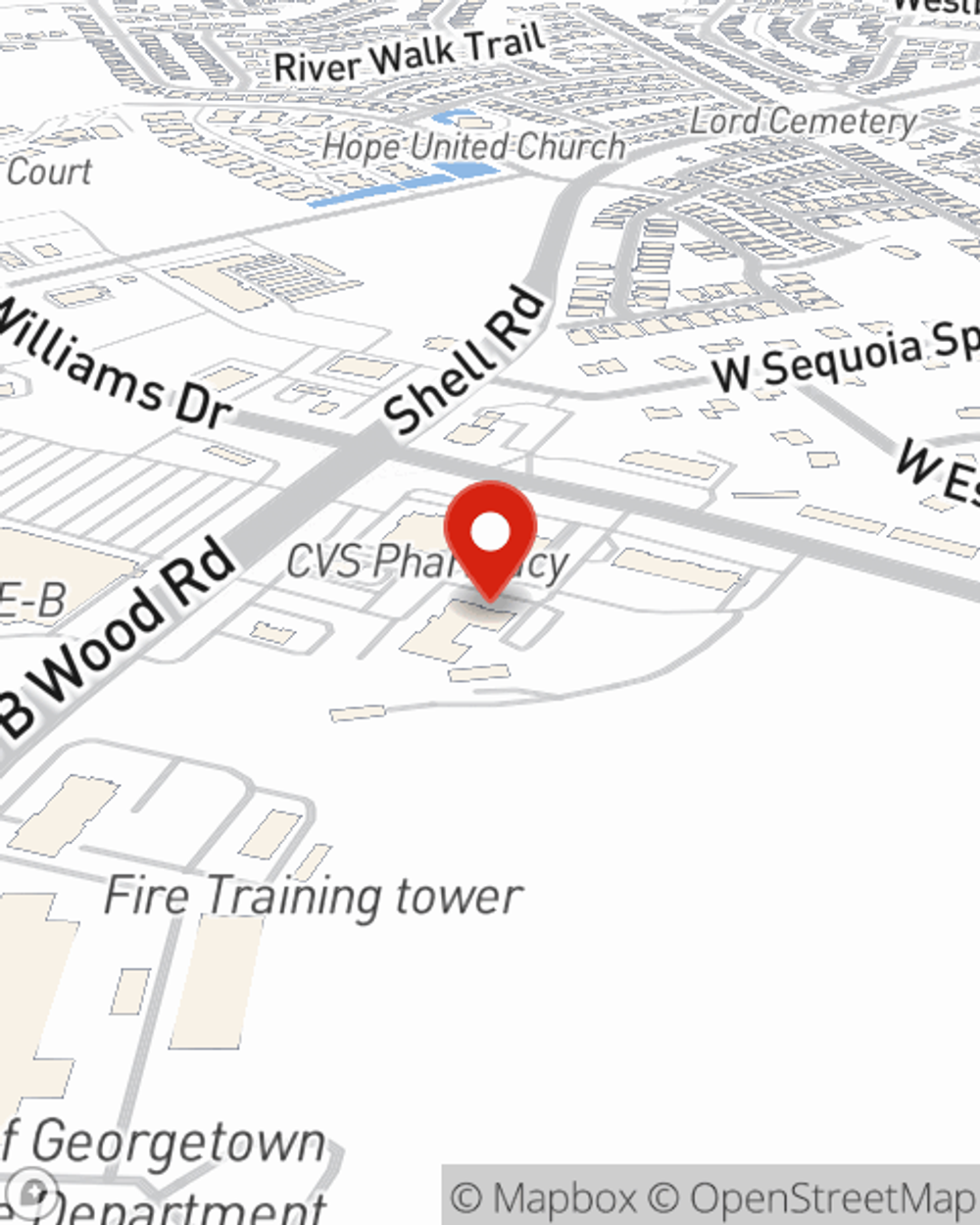

Allison Dickmann

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.